The foundation of modern economic systems

Prof. Dr. Hans Frambach / Economic Science

Photo: UniService Transfer

The foundation of modern economic systems

Economist Hans Frambach on Adam Smith, one of the most influential personalities in the history of economic thought and founder of modern economics

The Scottish philosopher AdamSmith, also known as the "father of classical national economics," was born 300 years ago. He is considered the founder of modern economic theory. Why is that?

Frambach: Adam Smith represents the overcoming of an old economic order shaped by the restrictions of earlier mercantile and physiocratic eras. He represents the turn toward economic thinking based on the fundamental value of freedom in the sense of Scottish Enlightenment philosophy, which propagated a system of so-called "natural liberty." Many have seen in this system an early blueprint for a free market economy that, by allowing individuals to follow only their own interests, could develop the full economic potential of a nation. In particular, with his Wealth of Nations, published in 1776, Smith presented a systematic and in-depth analysis of how economics works. In other words, he provided answers to how markets, trade and economic development work. In doing so, he relied heavily on the actions of individual actors, who, when freed from the many obstacles and barriers that existed at the time, were able to bring out the best for themselves and the community in a free, so to speak "competition-driven" cooperation based on the division of labor, as if controlled by an "invisible hand." That is certainly quite an achievement. He had the image of the old mercantile system in mind, in which there had been restrictions such as trade restrictions, no free choice of profession, the individual was restricted by the guild system, possible potentials simply could not be tapped. And Smith had written all this down and systematized it for the first time. The way in which Smith attempted to systematize and explain the complex economic processes is unique and fundamental to other subsequent works, including those such as those of Thomas Malthus, David Ricardo and John Stuart Mill, who would later go down in the history of economic theory as the great English classical national economists. Economic classicism was later extended in several ways, for example by neoclassicism. Many see in classical national economics already essential building blocks for the social market economy. And finally, movements such as socialism and the historical school of national economics also stem from the critique of classical national economics, at the beginning of which stands Adam Smith.

Smith is considered the forefather of capitalism and advocated social change without the influence of religion. Following the principle of reason, science and structures, as the foundation of truth, he wanted to establish economics as an independent scientific discipline. How?

Frambach: Smith himself had not yet used the term capitalism at all, and he did not speak of "capital," but of "stock," the description of the time for the financial basis of economic undertakings. Smith was a son of the Enlightenment who, in fact, advocated a more secular and rational approach to understanding economics, emphasizing the importance of reason and empirical observation. In doing so, he committed himself to the scientific understanding of economic processes and thus contributed to the emergence of economic theory as a discipline in its own right, in which religious influences were of little importance.

On the role of the state, he wrote: "No art does a government learn more quickly than that of drawing money out of people's pockets" and demanded that the state stay out of economic life. He conceded that only the market with its price mechanism had the ability to generate the greatest possible overall economic prosperity. Is he right about that?

Frambach: In a way, this is a very pointed question, to which one must give a differentiated answer. Smith believed that the main task of the state is to provide a framework for law and order, including defense against external threats, internal security, and the protection of private property. He saw a stable and secure society as an essential prerequisite for economic growth and individual well-being. Of course, he emphasized the importance of free markets, international trade, and other economic freedoms for consumers and producers to generate a country's wealth, but he was also aware of many limits that the free market may not be able to adequately meet, such as the provision of such goods that benefit a society as a whole as defense, infrastructure, and education. To portray Adam Smith as a naive believer in the market and an apologist for radical economic liberalism is clearly wrong. The famous quote from the "Wealth of Nations" about the art of a government to pull money out of people's pockets comes from the rather comprehensive fifth book there, "Of the Revenues of the State or Commonwealth," and there again from a very specific section on "Taxes on the Capital Value of Land, Houses, and Movable Property." Smith was referring in the quote to the introduction of a "modern financing instrument" on the European continent, namely the levying of stamp taxes and registration fees, mainly in France and Holland. Surely he was expressing the fact that governments are hardly lacking in creativity when it comes to revenue generation. In Germany, I believe, the only remaining stamp duty is the tobacco tax in the form of a stamped tax mark on the packaging or, in the case of cigars, on the banderole.

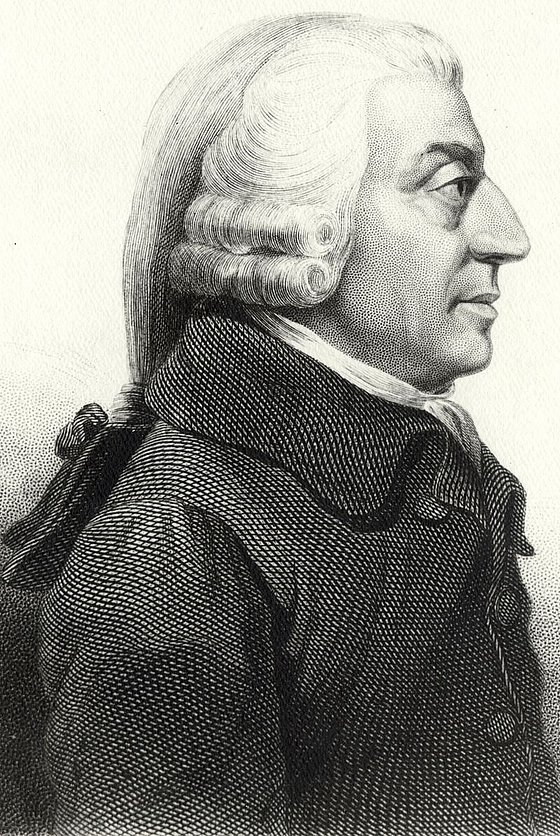

Adam Smith (1787)

in the public domain

Adam Smith shocked governments at the time by demanding that they let people buy and sell without hindrance. Wealth was redefined with and through him: It is not a possession (gold and silver) that can be stored in vaults, but is first created through the production process (labor). That was a change of perspective, wasn't it?

Frambach: That's right, it was a huge change of perspective. In the Wealth of Nations, Smith redefined the concept of wealth by no longer focusing on the creation of value by means of the accumulation of precious metals, but by focusing on human labor as the central factor in the creation of real economic value. Through the activities of human beings in the form of, for example, agricultural and forestry activities, the transformation of raw materials into further stages of production, etc., and thus ultimately the production of consumable goods, Smith formulated fundamental insights for the importance of the role of productive labor in the production process and thus also for the creation of wealth. Although Smith's conception of productive labor seemed rather peculiar in some respects (e.g. he did not count the activities of teachers, artists, doctors as productive work, for which he was severely criticized - though he did not deny their usefulness), the theory of value was further developed on the basis of his insights. In the preceding epochs rather the view of values provided by the earth prevailed, which so to speak the dear God created. By directing the view to the human activity, the work, the human being himself moves as value creator into the center. That was new. It should not go unmentioned that for Adam Smith "wealth" does not only mean the accumulation of goods and resources that contribute to the well-being of a country's population; he also included factors such as the extent of a functioning institutional framework (infrastructure, legal system, external security, cultural education, etc.) and, of course, the advantages that arise from exploiting the division of labor and specialization, quality of work, innovative performance, technical progress and the possibilities of free (exchange).

His main work from 1776 under the title "The Wealth of Nations" is still relevant today. Can you explain that?

Frambach: With the "Wealth of Nations," Adam Smith laid the foundation for modern economics by introducing central concepts such as the division of labor and specialization, the role of markets in the distribution of goods and resources, making explicit the importance of labor as a factor of production, advocating free trade, internationalization and technical progress, and already giving a behavioral economic dimension to the explanation of economic action by assuming individuals driven by self-interest. By describing the economy as a self-regulating process controlled as if by an "invisible hand," he provided new insights into the functioning of complex systems that continue to shape debates on the benefits of free markets, their limits and the need for government intervention to the present day. In all of this, Smith had clear ideas about the role of the state, which was to provide an institutional framework (protection of life, security of private property, contract security, etc.) to secure and expand the prosperity of its citizens. Moreover, Smith's work was crucial for the formulation of essential philosophical foundations of capitalism. To address and elaborate this plethora of aspects in a single work, The Wealth of Nations, is unique and a credit to Adam Smith that cannot be overstated.

The origin of the economy lies anchored in man's natural inclination to barter and trade, Smith formulated, referring to the tribes of America. But capitalism is not the realization of a concept, but the result of a historical process. So what is true?

Frambach: Smith spoke of people's "propensity to barter," but he did not mean only the exchange of objects, as expressed, for example, in the example of Native American tribes in the "Wealth of Nations." Smith compared the economic practices of Native Americans with those of European nations. He perceived a higher material prosperity among the latter and justified this, among other things, by entirely different economic structures, one based on common ownership of land and resources among American tribes and private ownership among European countries. Moreover, he saw the Western nations as superior. For Smith, the "propensity to exchange" is also an expression of the interdependence of people (man as a social being), a mutual dependence that increases as societies grow. The ever more complex mechanisms of production and organization require ever new adaptations. Thus, capitalism can certainly be understood as a result of certain conditions of production, such as private ownership of the means of production, free markets, competition, the profit motive, individual entrepreneurship, and a new mode of production made possible by "capital accumulation." Likewise, capitalism can be understood as a result of historical developments. Of course, capitalism is a complex economic and social system that has evolved over time. One example, for example, is the transition from feudalism to capitalism, due to changes in agricultural practices, urbanization, trade, technological advances, changes in property relations, and social structures. I do not believe that capitalism was conceived and then realized as an a priori construct of some sort, that is, a fictional "concept." Rather, I conceive of capitalism as the result of a dynamic interplay between conceptual ideas and historical realities.

In his book, Wealth of Nations, he concludes by advising his homeland to accept its own mediocrity. For Smith, mediocrity was a symbol of progress. How can we understand that?

Frambach: Mediocrity, moderation and self-sufficiency are points that played a role for Smith. In those days, for example, it was seen as a great danger if a state relied too much on importing goods from abroad and thus weakened a country's self-sufficiency - think of the current example of the Federal Republic of Germany with regard to energy imports. A certain maintenance of "mediocrity" (in the sense of independence) in self-sufficiency potentials, even if others are better in some production references, may then seem quite prudent in terms of a self-preservation strategy. Smith's conception of "mediocrity" was by no means about advocating stagnation or accepting lack of ambition. Instead, he believed that steady and sustained economic growth based on productive labor, innovation, and balanced trade would lead to better outcomes for a nation's citizens. This contrasts with the old mercantilist policies that focused primarily on the accumulation of precious metals and the maintenance of trade surpluses as a measure of national wealth, which Smith considered counterproductive to true economic progress.

What influence did Adam Smith have on the development of economics, and how is he remembered today?

Frambach: Adam Smith is considered one of the most influential figures in the history of economic thought. His influence on the development of economics was profound and enduring. Even in the year of the 300th anniversary of his birth, his legacy is still of outstanding importance for the understanding of economic processes. Smith's ideas have shaped the way economists think about the division of labor, markets, trade, globalization, competition, and government intervention. Smith's analysis of the self-regulating nature of markets and his confidence in the effectiveness of competitive mechanisms and individual self-interest have strongly influenced the understanding of the dynamic functioning of markets, their limits, and an appropriate role of the state for the best possible development of an economy. Adam Smith's ideas laid the foundation for the development of modern economic systems that are capable of reasonably satisfactorily reflecting the phenomenon of rapidly developing economies, always with the goal of increasing prosperity for all. For the explanation of capitalism as an economic and social order, it is indispensable, even if the problems that arose with the development of capitalism were not yet grasped by Smith in many cases.

Uwe Blass

Prof. Dr. Hans Frambach is head of the Department of Microeconomics and History of Economic Thought in the Faculty of Economics, Schumpeter School of Business and Economics at Bergische Universität.